FinTech has been the center of Innovation since it’s very inception. In 2017 alone, investments in FinTech rose to $12.85 billion. The FinTech sector is looked at as the technology that has really shaken up the existing Finance market and has a lot of people excited about its potential to change the way we carry out our transactions. It’s not just plucky startups that believe in FinTech; Banks and other financial Institutions are partnering with existing FinTech companies or looking to build and provide solutions of their own. That’s not all, Many Fintech solutions are being promoted by Government’s across the globe, like the Unified Payment Interface (UPI) system which has found great success in India. These Fintech solutions are playing a major part in increasing transparency and improving security in day to day transactions.

So where does IT come into FinTech? To begin with, FinTech or Financial Technology has huge takers in the public sphere with people wanting instant access to financial services and software solutions are doing just that. Through mobile application development services amongst many others, customers are now able to evade long wait times, slow bureaucracies and counter-intuitive documentation and verification that would stop many potential customers from using banking services.

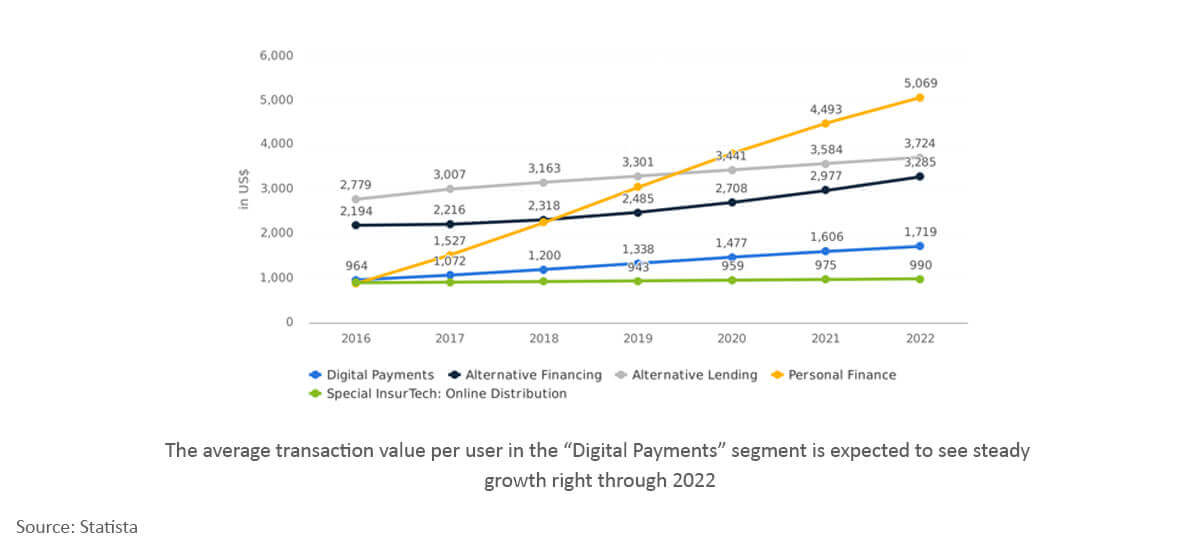

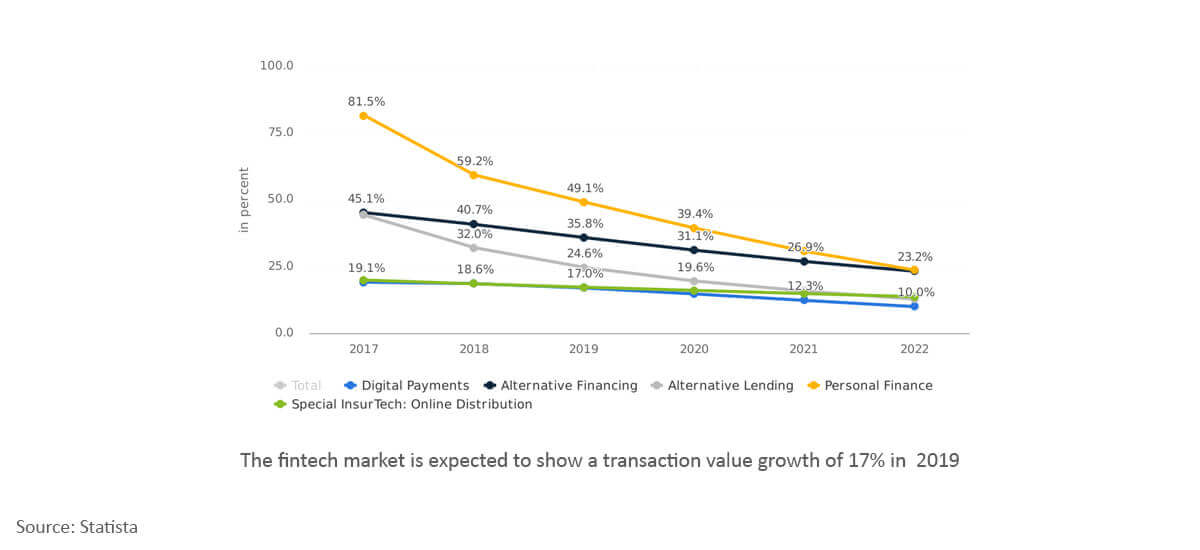

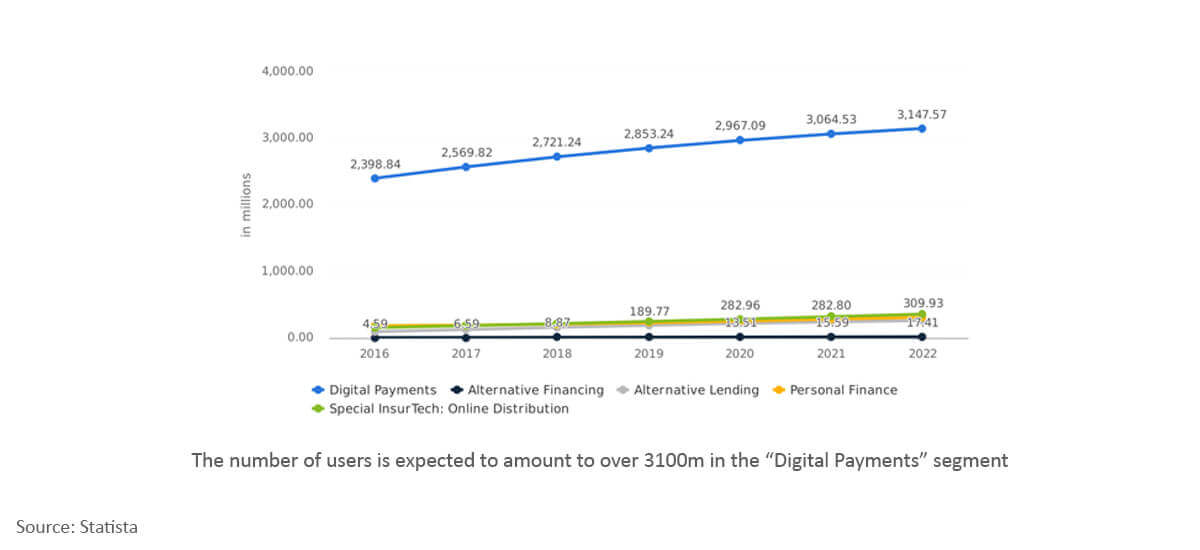

2017 was a great year for innovation in the FinTech sector and 2018 is already well on it’s way to being another successful year for the sector. The growth rate for FinTech apps stands at 30% a year (Source: Statista) and FinTech applications have found great success in the alternative lending sector, with its clients being people who are fed up at the glacial pace at which traditional lending occurs.

Ready to Innovate in FinTech?

Book a meeting with our experts to explore secure, scalable, and regulation-compliant software solutions tailored for today’s fast-moving financial landscape.

Keeping that in mind, Here are the Top 7 FinTech Trends that seek to define this decade

1) Data Analytics and Artificial Intelligence are the way forward

It’s a well-known fact that Data Analytics has drastically affected any industry it has been used in, and the FinTech, and by extension, the Finance Industry is no exception. 4-5 years ago, a business would have gathered data and used it to make decisions that would achieve their desired impact a few years later.

As 2018 progresses, leveraging advanced AI solutions to decrease costs and manage overheads will gain popularity. Artificial Intelligence is also poised to play a major role in fraud detection and customer analytics as well.

2) Chatbots will walk the talk

Many major banks worldwide have adopted chatbots for smooth and uninterrupted interactions with clients, allowing them to test the waters in the FinTech sector. By 2020, we can expect chatbots to be deployed in various capacities, mimicking human behavior to a degree which would it make it impossible for the person engaging them to be able to tell otherwise. Voice based Assistants are also expected to play a major role in easing skeptical customers into the FinTech environment.

3) Efficient Regulations

Although having little to no regulations helped greatly in FinTech, there was no doubt in anyone’s mind that they would be coming soon. In FinTech’s case, regulations can be a good thing. Instead of restricting transactional freedom, Regulations can inspire confidence amongst investors and clients alike, and confidence in an industry based around Finance is invaluable. Specialists expect legislation to add structure to the market, especially when it comes to data privacy, anti-money laundering policies and Digital ID’s.

4) Financial Automation

Banks and other Financial Institutions are planning to leverage FinTech to personalize their consumer offerings. App functionality and design will change over time as per individual usage. This is expected to go a long way in helping the customers feel more involved and promote efficient self-service.

5) Blockchain

77% of Global FinTech Survey respondents are planning to adopt Blockchain by 2020, mainly in Fund Transfer and other Payment Infrastructure. Blockchain is no longer an experimental concept, it is now out in the real world and FinTech stands to benefit greatly from it. Blockchain is expected to get cryptocurrency into the mainstream. Blockchain will likely change the face of how security is handled in the FinTech sector and should ease the minds of investors worldwide.

6) Machine Learning

Banks and Financial Institutions are already in the process of adopting new regression models which are powered by Machine Learning to deliver innovatively compute and deliver solutions. Data Scientists the world over are excited about the insights that can be generated about customer expectations and behavior. Machine Learning will allow banks to predict customer needs and personalize their solutions for individual customers.

7) FinTech Integration with the Internet of Things

The Giants of the International market, Samsung, Amazon, Bosch etc. have already invested in the Internet of Things. By 2020, Traditional Financial Institutions, as well as FinTech startups, are expected to be fully entrenched in the Internet of Things environment. For a lot of parts of the Internet of Things to work, our smart devices need to be connected with our bank accounts or other financial services. For example, A smart fridge can automatically order groceries when certain food items are running low, but it needs to be integrated with the owners’ bank account to be able to do so. FinTech aims to seamlessly integrate the two in a secure manner.

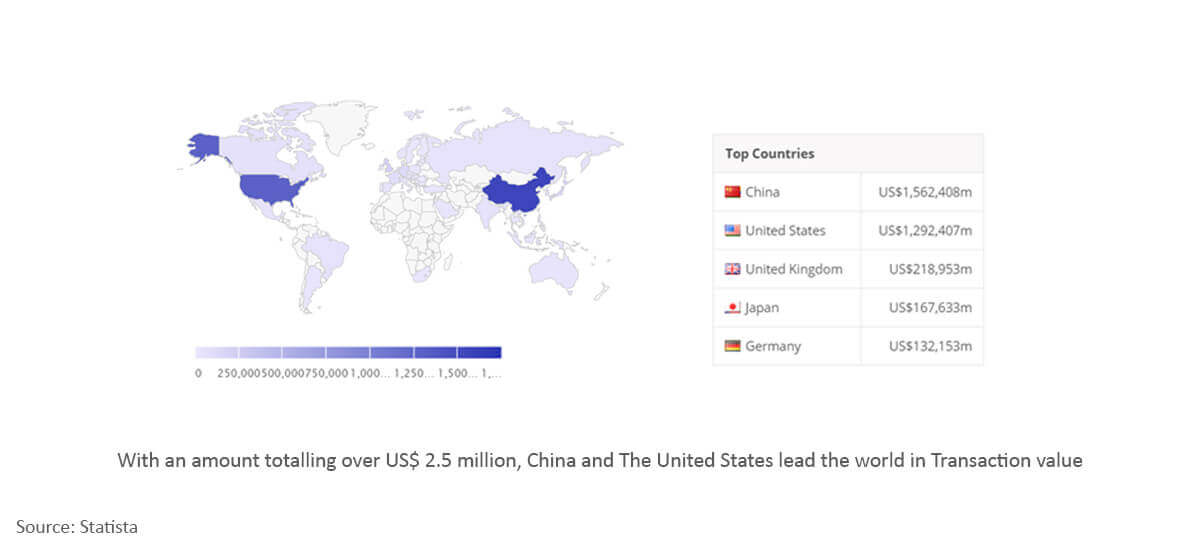

You may be wondering why mobile wallets have been left out of this list. That would be because as of 2018, they’re already an integral part of most people’s daily lives. Many a Mobile application development company has worked with the FinTech Industry to deliver intuitive and convenient solutions for instantaneous payment. FinTech has a big role to play in how virtually every market is shaping up and should be a dominant player by the end of this decade. Consumers are more open than ever to blend tech innovations in their daily lifestyle. The Indian FinTech space alone is expected to reach an estimated $2.4 billion by 2020, so for anyone looking to get in on the FinTech industry, now is the time.

MDS Development Services for your FinTech Requirements

If you are seeking to make your mark in the FinTech Industry, do consider MetaDesign Solutions. We have worked with many clients in the FinTech sector and would be able to provide the ideal solution for your requirement.

Related Keyphrase:

#Fintech #FintechTrends #FinancialTechnology #FintechServices #TechSolutions #DigitalBanking #FintechInnovation #FintechDevelopment #TechInFinance #Blockchain #AIInFinance #FintechConsulting #HireFintechDevelopers #FintechAppDevelopment #TechInFintech #Cryptocurrency #HireTechExperts #FintechCompany #FintechSoftware #RegTech #FintechSolutions #DigitalTransformation #FintechDevelopmentCompany #FintechServicesCompany #TechConsulting #SoftwareDevelopmentServices #FintechApps #FinancialServices #FintechDisruption #HireSoftwareDevelopers #FintechSoftwareDevelopment #TechInnovation #FintechInvestments #FinanceTechnology #CustomFintechDevelopment #AppDevelopmentCompany #FintechAppSolutions #SoftwareEngineering #BusinessSolutions #TechForFinance #FintechRegulation #FinancialInnovation #FutureOfFinance #FintechTechnology